Six key takeaways from our benefits of RPA for finance teams webinar

A recent Agilisys webinar discussed the many benefits finance teams across the healthcare sector can realise from robotic process automation (RPA). From cost savings to efficiency gains and enhanced workforce retention, here are six key takeaways from the not to be missed session. Watch the full webinar on-demand to further explore how NHS finance teams […]

A recent Agilisys webinar discussed the many benefits finance teams across the healthcare sector can realise from robotic process automation (RPA).

From cost savings to efficiency gains and enhanced workforce retention, here are six key takeaways from the not to be missed session. Watch the full webinar on-demand to further explore how NHS finance teams can realise these benefits and more.

1. Accuracy, productivity and compliance are just three of the multiple benefits of RPA for NHS finance teams

If you have a process where accuracy is essential, RPA will perform the same job repeatedly, without making mistakes or deviating from the process. In contrast, it’s natural for humans to lose focus and drop attention when performing repetitive tasks, creating the potential for error.

Accuracy goes hand in hand with speed too. RPA can complete processes eight to ten times faster than a human, which means it’s the ideal tool for clearing backlogs or where you’ve got peaks and troughs in activity – month-end processing is a good example.

When it comes to compliance, RPA will never diverge from precise rules and will provide a full audit trail of every transaction and share reports. Finance teams will have a complete transactional history, not only from the application but from the RPA process too.

2. One of the most significant benefits of RPA is its 24/7 availability

An example of RPA in action shared in the webinar was the automation of the Employee Staff Records for NHSBSA. In the first two months of use, the time taken to manually process requests reduced from 21 days to 13.

That translates to around 90 hours of effort that the ESR team did not have to spend managing and maintaining the system.

Simon Watkins, Head of RPA delivery at Agilisys, commented in the webinar: “21,000 transactions were processed for one NHS trust in approximately two weeks, which would normally have taken well over four and a half weeks to complete manually, using multiple members of staff, because we could scale up the bots to run 24/7.”

3. An often-overlooked benefit of RPA is the improved customer experience

By automating processes, customers can receive faster responses. Simon explained: “We commonly come across instances where organisations have, for example, digitised requests for information on the front end through a website, but the response is delayed because there’s a backlog caused by manual processing. By automating the back end, feedback to customers is a lot faster.”

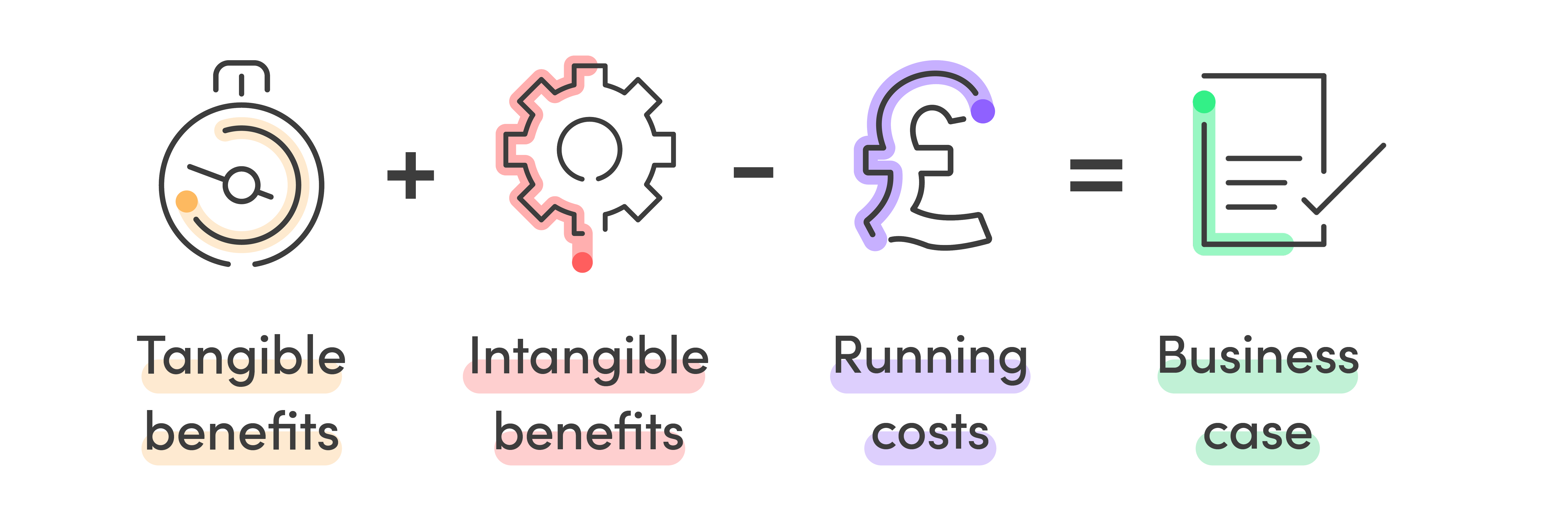

4. Tangible benefits + intangible benefits – running costs = business case

The business benefits of RPA can be defined by bringing together tangible benefits with intangible ones and deducting running costs.

5. Education and awareness is the first step in an RPA journey

When asked how organisations can effectively start their RPA journey, Simon suggested the first step is all about building awareness of what RPA is and what it’s good for…and proving its value.

“Educating people on automation will both drive interest and start teasing out opportunities.

Once you’ve identified which process is the start point for automation, get this into production quickly to show the benefit, as this builds interest around the organisation to do more.”

6. Return on investment is a crucial measurement of RPA success

Simon shared half a dozen examples of the ROI realised from several Agilisys RPA implementations across healthcare. These included one organisation that automated the creation of around 6,000 creditors and debtors each year, saving approximately 1,500 hours per annum.

The manual process to create each creditor or debtor involved multiple different income request forms and took approximately 20 minutes for each. By automating the process, the time was reduced to just five minutes – and included further benefits such as introducing a single form for all services, fully automating the validation against the organisation’s finance system, and automating the email authorisation process.